Scalping vs Day Trading: What’s the Difference?

You’ll also get access to news and independent research on stocks you’re following as well as a mobile app that helps you stay connected on the go. Fidelity is a top stock trading app offering several investment products catered to all kinds of investors. Read more at consider your personal circumstances before deciding whether to utilize Betterment’s TLH+ feature. Benefits: i Effective Communication ii Speedy redressal of the grievances. Strike Price Interval. Harinatha Reddy Muthumula, TEL: 1800 833 8888; Email: for DP related to , for any investor grievances write to. You’ll notice our top choices in this listing also rank highly in other brokerage, robo advisor and crypto exchange listings we’ve conducted. With a rising wedge, the support line will usually be steeper than the line https://pocketoption-ru.online/viewtopic.php?t=405 of resistance. Forex rates are based on interest rate differentials between the pair’s currencies. Correspondence Address: 10th Floor, Gigaplex Bldg. Let’s browse through the basic differences between a trading account and a profit and loss account. When there are more buyers than sellers in the market, demand is greater, and the price goes up. Regardless of the formation specifics, the goal as a trader is to determine the path of least resistance once the stock leaves the formation. By rejecting non essential cookies, Reddit may still use certain cookies to ensure the proper functionality of our platform. Borrow up to 50% of your eligible equity to buy additional securities. Different commodities may have different trading times. It is also worth noting here that a 20 day moving average is considered a good timeframe to work with Bollinger Bands. Subject company may have been client during twelve months preceding the date of distribution of the research report. They are issued by a central authority. If you are trying to buy, the algorithm will try to detect orders for the sell side. What’s more, it’s difficult to stick to one’s trading discipline in the face of challenges such as market volatility or significant losses. Marketing partnerships. Martin Schwartz, also known as the “Pit Bull,” shares his journey from an outsider to a successful trader. For some, it’s as simple as buying a put when bearish and a call when you’re bullish. Most online brokers no longer charge a commission to trade stocks. Intraday and delivery trading are two of the most popular stock market trading strategies.

Trading for Beginners: How To Start Trading With $500

Bajaj Financial Securities Limited or its associates may have received compensation from the subject company in the past 12 months. To gain a better view of market circumstances, it’s always a better idea to evaluate the performance of other stocks as well as market indicators. Explore rewarding career opportunities with us. Use limited data to select content. However, this does not influence our evaluations. Compare your performance with how you did when paper trading the strategy. There are many self purported “trading systems” promoted online. At Appreciate, your security is our utmost priority. So, I picked the most popular brokers in Switzerland. Liquidity is how quickly you can buy and sell a security without compromising its price. How to Read Stock Charts. Ideally, you’ll take the trade short on the break of the signal line, setting your stop at the high of top 2. Therefore, any accounts claiming to represent IG International on Line are unauthorized and should be considered as fake. Know where you are going to get out before you get in, and place a stop loss order, whenever possible. Nison’s expertise in this form of analysis allows traders to enhance their ability to interpret market movements, identify trend reversals, and make more informed trading decisions based on chart patterns. Understanding RSI values can significantly enhance a trader’s ability to make informed decisions about when to enter or exit positions. Think of it as a “floor” where demand for the assets increases. Research and Analysis: Many trading apps offer research tools, news, and real time market data to help users make informed investment decisions. I should also note that the eToro app is suitable for those of you that wish to diversify into other asset classes. This is to ensure that if one sector or country were to experience a sudden fall in value for any reason at all, the remainder of your portfolio would be robust enough to prevent you from experiencing a complete loss. A call option to buy $10 per point of the FTSE with a strike price 7100 would earn you $10 for every point that the FTSE moves above 7100 – minus the margin you paid to open the position. Robo advisors such as Betterment and Wealthfront can be good options for those who prefer a more automated approach to their portfolio. That may not sound like a lot, but, assuming consistent returns, it could amount to earning $170,000 more if an insider traded $1 million over several months. Before jumping into investing, figuring out how much money you can lose should things go wrong is crucial. Access one of the world’s largest FIX based order routing networks, transacting over 40 billion shares a day across five continents and 20 time zones: trade equities, options, futures, FX and fixed income. Portions of this page are reproduced from work created and shared by Google and used according to terms described in the Creative Commons 3. Yes, you can day trade cryptos. He helped publicize the technique and train institutional traders and analysts at top investment banking firms.

Conclusion

Read my full review of IG to learn more about why I’ve rated IG so highly for so many years. Trade takes place in organised stock markets with rules and regulations that all entities must adhere to. Advanced level trading options. All customers, regardless of account level, get a 1% match on IRA transfers and 401k rollovers. Covered calls provide downside protection only to the extent of the premium received and limit upside potential to the strike price plus premium received. Personally, I prefer to stick with Tier 1 regulated brokers because they are governed by regulatory bodies like the FCA and CySEC. It focuses on the theoretical, empirical, and experimental research on the market. Our pattern recognition scanner helps identify chart patterns automatically, saving you time and effort. Although the golden cross pattern is pretty straight forward, here are a few examples for you to use as a cheat sheet when trading. Some traders only use a specific number of patterns, while others may use much more. This was mainly to expand my horizons the 26k was just so i could buy and sell same day mainly only intended to use 1k in actual trades. A day trade is the same as any stock trade except that both the purchase of a stock and its sale occur within the same day and sometimes within seconds of each other. Trading Price Action Trends: Technical Analysis of Price Charts Bar by Bar for the Serious Trader. Many exchanges charge fees to withdraw coins from their platform. When that isn’t the case, it’s incredibly dangerous, and you could lose a lot more money than you can afford. Charles Schwab was a close contender for first place in several of our categories. It is up to you to become self sufficient in the market. Gain unlimited access to more than 250 productivity Templates, CFI’s full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real world finance and research tools, and more. Investments in securities market are subject to market risks. The specific amount of money you’ll need for online forex trading will depend on multiple factors, such as your personal financial situation, your trading goals, and your tolerance or appetite for risk. Robinhood Crypto is licensed to engage in virtual currency business activity by the New York State Department of Financial Services.

FAQs on Learn to Trade Stocks FAQs

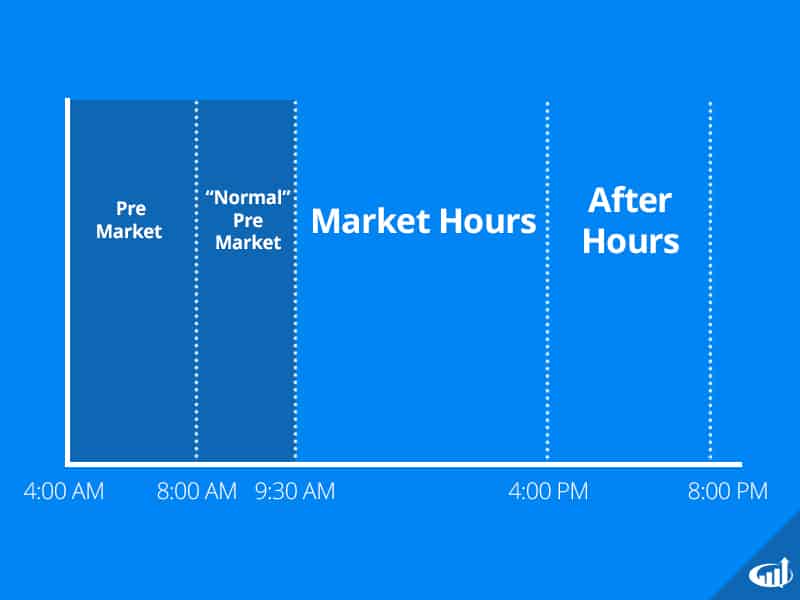

Volume dots in Bookmap show real time traded volume at specific price levels. Successful forex trading demands a good grasp of currency fundamentals, global economic indicators, and geopolitical events that can influence currency values. Day trading is a form of speculation in securities in which a trader buys and sells a financial instrument within the same trading day, so that all positions are closed before the market closes for the trading day to avoid unmanageable risks and negative price gaps between one day’s close and the next day’s price at the open. Depending on the duration of the trade, one can use a simple moving average, which is the most popular type among moving average types. Smart Investing Courses. If you’re an investor, the broker may also provide research, such as reports on the company’s business and prospects for the future. 27 BKC, C 27, G Block, Bandra Kurla Complex, Bandra E, Mumbai 400051. There are professional day traders who work alone and those who work for a larger institution.

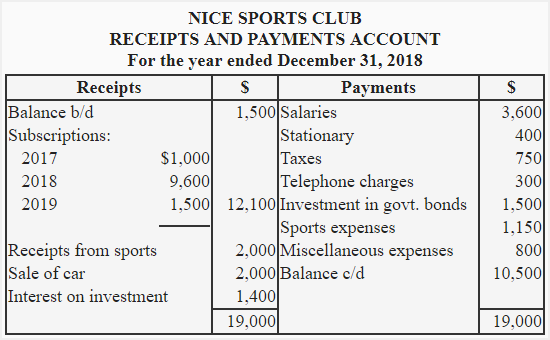

Statement of Profit and Loss

I was working on it days and nights with passion, and after countless iterations, I finally succeeded in creating a bot that trades autonomously with a solid risk management and a healthy return on investment. Because options contracts have an expiration date, which can range from a few days to several months, options trading strategies appeal to traders who want to limit their exposure to a given asset for a shorter period of time. The content published on this website is not aimed to give any kind of financial, investment, trading, or any other form of advice. “insider screener offers the best tool for identifying and monitoring insider activity I’ve found on the web, hard stop. Finance apps generally stop at being able to display your brokerage account balance as part of your overall financial picture. Financial industry regulations permit an investor to borrow up to 50% of the purchase price of securities on margin, which is stipulated in the Federal Reserve Board’s Regulation T. However, like any other business, it requires planning, organization, and a lot of hard work. It is a reversal chart pattern as it highlights a trend reversal. There are number of risks associated with trading – and one of them is trading with leverage. At Sarwa Trade, you can buy and sell stocks and ETFs at 0. The seller of an option will only realize their gains if they buy back the contract for less than the sale price or if the contract expires worthless. It has a long upper shadow, a small body, and a short lower shadow. They argue that, in most cases, the reward does not justify the risk. You can also learn the market via the paper trading tools offered by many online stock brokers. For your position to be profitable, you’ll need the market price to either rise above the buy price or fall below the sell price – depending on whether you’ve gone long or short. Learn how to start trading on our Next Generation trading platform. To make trading decisions easier and gain more profit, you need to be equipped with the best tools in the field. On Angleone’s secure website. The option that can be exercised only on the expiry date. Jane Eslabra has 14+ years of experience producing content across traditional and digital platforms. The RSI fluctuates between 0 and 100, offering a measurable indicator to detect when the market is overbought or oversold. The key characteristics of a day trader is that they open and close their open trading positions within the same trading day. Here’s an extensive list of them. He holds the Chartered Financial Analyst CFA and the Chartered Market Technician CMT designations and served on the board of directors of the CMT Association.

What Should You Choose? Futures vs Stocks and ETF:s

Below are eight books essential for understanding chart patterns. Therefore, adhering to these principles can pave the way for successful swing traders in the world of swing trading, by following a successful swing trading strategy. If you have a $40,000 trading account and are willing to risk 0. It essentially becomes practice trading, particularly for those new traders getting started with investing. It’s most easily observed in markets with high liquidity and volatility, but really anything that is bought or sold in a free market will generate price action. In case of a new query, click on Continue. Colour Prediction Game Earn. Learn how to ride the waves of stock price movements. You pay cash for 100 shares of a $50 stock: $5,000. Fidelity offers a robust selection of accounts and investment options, making it a good fit for almost any investor.

Disadvantages

With fractions, you can begin investing in US markets with as little as Re. Positions arising from client servicing include those arising out of contracts where a firm acts as principal even in the context of activity described as ‘broking’ or ‘customer business’. Key Advantages of DEGIRO. OnSoFi Active Investing’sSecure Website. Volatility gives an indication of how the price is changing. Beyond puts and calls, options contracts vary in their underlying assets and longevity. The three candlesticks are characterized as follow. Paxos evaluates forks and airdrops on a case by case basis. Even better, you’ll know the success rate for each of the patterns, according to the Encyclopedia of Candlestick Charts by Thomas N. Important concepts and features: A Doji alone is not a signal and should not be traded by itself. The problem has been fixed, app no longer freezes when I open certain pies in my account, emailed T212 Mid December, and the problem was fixed within the first week of the new which is greatly appreciated, now I can go back to investingI used the app to trade and invest on my old phoneSamsung galaxy S10+ and it worked fine no problems it was smooth, recently upgraded to the iPhone 12 pro, however I can’t use the app properly/ if at all, as the app keeps freezing and crashing when I open certain pies in my trading investing account, I can’t open or edit them cause it’ll just freeze, major bug problem that’s need to fixed ASAP as the app is unusable if not. Trading on margin comes with risk, because the position is still based on full exposure. Though I found the stock trading on Impact and Global Trader to be very similar, I also enjoyed using Global Trader to speculate in foreign currency, even if it was only a few dollars. If you are interested in the robo advisor sector but find the account minimum too steep, then robo advisors like Betterment may be a better fit as it requires only $10 to start investing. If the stock falls only slightly below the strike price, the option will be in the money, but may not return the premium paid, handing you a net loss. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w. Some brokers go a step further and allow you to purchase fractional shares, so you can purchase less than one share. Pay margin interest: $400. You may also be interested to know. It is a user friendly platform that makes it easy for beginners to buy, sell, and store cryptocurrencies. Other leading robos, like SoFi Invest, Acorns, Ellevest and Schwab Intelligent Portfolios, charge monthly subscription fees of $0 up to $30 a year. Ideal exit would be the day before fomc because that’s a pretty unpredictable event. Other factors — such as access to a range of investments and the quality of the research — may be more valuable than saving a few bucks when purchasing shares.

Fees

This means that if the value of a stock rises, you make money. Best crypto exchanges for beginners would have a UI that mimics that of a traditional broker for familiarity, along with an extensive library of resources to make informed decisions. Trading a system with a demo account in real time is called forward testing. For the brokers that filled out these profiles, we audited the information for any discrepancies between our data and the broker’s data to ensure accuracy. Today there are about 500 firms who participate as market makers on ECNs, each generally making a market in four to forty different stocks. By signing up, you agree to receive transactional messages on WhatsApp. Intraday is also referred to as Day Trading and it involves the purchase and sale of the stocks within the same trading day. View more search results. Moreover, the trade account format also facilitates the differentiation of operating and direct expenses. Minimum Withdrawal: ₹100/. The meticulous combining of option trading indicators can yield advanced indicators for option trading, providing unparalleled market insight and bolstering trader success. Q Which type of product is the best for a trading business. These include straddles, strangles and spreads. Just like when working with different brokers for trading stocks, fees can vary from crypto exchange to crypto exchange. In addition to its other features, Cash App makes it easy to buy, sell, and transfer BTC in just minutes. Schwab One® Brokerage Account has no account fees, $0 commission fees for stock and ETF trades, $0 transaction fees for over 4,000 mutual funds and a $0. Thank you for reading CFI’s guide on Insider Trading. The best online brokerage platforms provide strong customer support, robust research and analytical tools, a wide range of assets, numerous account types, and more—all with a transparent fee structure and limited gamification tactics regardless of the investment amount. It helps traders understand the strength and direction of a trend. “”We understand that certain investment advisors may be approaching members of the public including our clients, representing that they are our partners, or representing that their investment advice is based on our research. These traders often require tools like Level 2 quotes that provide detailed liquidity information about the order book and hot keys for rapid ordering. Yes, if they help you trade profitably. Candlestick pattern consisting of one candle. ^IG International Limited is part of the IG Group and its ultimate parent company is IG Group Holdings Plc. For the most recent holiday schedules, traders should verify with their local exchanges, as this information may be subject to change. Or in simple terms, your money is not kept alongside the trading app’s. In general, standard option valuation models depend on the following factors. When it comes to the financial markets, there are endless possibilities for making and losing money. This will help you to work against the odds and beat stock market volatility.

Company

The gravestone doji pattern is formed when the market experiences a strong bullish momentum followed by a sudden rejection of the higher prices. If you’ve been trading for any length of time, you know this happens. Proper due diligence has been done for the images and the image is not of any artist. Monday Friday, 7:30 AM to 8 PM EST. As with pennants and flags, volume typically tapers off during pattern formation, only to increase once price breaks above or below the wedge pattern. 3 Multiple Access Ltd. 50 at expiration, the option will expire in the money ITM and be worth $16. Success requires a deep understanding of market trends, quick decision making, and effective risk management. The earliest known use was by famed Japanese rice trader Munehisa Homma in the 1700s. Risks in swing trading are commensurate with market speculation in general. For instance, calls, puts or spreads. BSE / NSE / MSEI CASH / FandO / CD / MCX – Commodity: INZ000041331; CIN No. I consider Mark my mentor, and this book is still a must read. By implementing risk management strategies such as using stop loss orders, diversifying your portfolio, and understanding the risks associated with different strategies, you can protect your capital and increase your chances of profitable trading. The models are driven by quantitative analysis, which is where the strategy gets its name from. I also highly recommend listening to the memos of billionaire Howard Marks Oaktree Capital. It can be upward bullish, downward bearish, or sideways neutral. Consistent saving and investing required to build a meaningful investment amount. This can help traders spot trends faster. Thus, this obscurity raises questions about accountability and risk management within the financial world, as traders and investors might not fully grasp the basis of the algorithmic systems being used. It can also become increasingly necessary if you https://pocketoption-ru.online/ have significant assets. Currently I’m at two weeks.

Bearish

“IG Group and tastytrade Complete $1 Billion Partnership. We opened accounts at each of the 20 brokers in our survey to perform hands on, granular testing of their platform and services. In other words, intraday trading means all positions are squared off before the market closes, and there is no change in ownership of shares as a result of the trades. Trading can be done even with a weak internet connection. Fundamental analysis will measure a company’s intrinsic or actual monetary value by taking into consideration certain economic and financial factors, like its balance sheet, management forecast and macroeconomic markers. Issued in the interest of investors. “Derivatives Essentials: An Introduction to Forwards, Futures, Options, and Swaps. The body of this candlestick has to be at least the same size as the first candlestick or bigger. Through complying with relevant legislation, we meet the highest financial regulation standards. Intraday traders will have a chance to deal with the information impact in real time. Our shortlisting criteria comprise various factors to pick and choose the best recommendations for you. INR 0 on equity delivery. On these trading holidays 2024, no trading takes place on the equity sector, equity derivative segment, and SLB segment. Each market will close early at 1:00 p. If you continue to use this site we will assume that you are happy with it. Deutsche Bank Research. They’re always quick torespond, super helpful, and care about sorting out any problemsyou might have. This pattern applies in bullish and bearish markets and can be a valuable tool for those looking to capitalize on trend reversals. If you have been investing in the stock market, you may want to open a separate account for intraday trading. Bollinger Bands can be an effective tool for traders looking to capitalize on market volatility and price patterns.

Products and pricing

If the line goes below 30, the asset is oversold. By default, it uses the SPY Top 40 stocks, but can be changed to any tickers. But on any day that your position declines in value and takes you below the maintenance margin, you’ll be forced to put up more cash so that you always have at least that $6,039 in minimum margin. Read our full SoFi Invest review. A user friendly interface is essential for a crypto trading app as it makes the buying and selling process simple and easy to understand. For instance, the positions could belong to purchasing the asset first and selling the item afterwards selling the asset first. Our websites use cookies to offer you a better browsing experience by enabling, optimising, and analysing site operations, as well as to provide personalised ad content and allow you to connect to social media. Custom alerts are another essential feature for futures traders on TradingView. If you’re new to technical analysis, you might want to review the basics. Hence, if a trader can accurately predict the swings trading, this type of trading is the best strategy they need. Your broker may have additional requirements, such as disclosing your net worth or the types of options contracts you intend to trade.

DOWNLOAD THE APP

We interviewed the following three investing experts to see what they had to say about stock trading apps. For more information, please see our Cookie Notice and our Privacy Policy. Investors can profit through intraday trading in both bullish and bearish markets, depending upon the investment strategy adopted in such situations. Our exhaustive research has found that ETRADE is our overall pick for best investment and trading app because of how it optimizes its mobile platforms to include the right selection of research and account amenities, intuitive and user friendly navigation, complex trading technology, and more. We’ve said it before, but it is worth repeating. There are a number of risk management tools you can use when trading, such as stops also called stop losses and limits. In addition, we’ll do our best to reward the most helpful users. You can open up most major investment account types to buy stocks with Merrill Edge® Self Directed’s free trading app, including individual brokerage accounts, IRAs, SEP and SIMPLE IRAs, custodial accounts, small business accounts, and more. Digital assets held with Paxos are not protected by SIPC. The basic concept of leverage, also known as margin trading, in the stock market is borrowing money to invest in more stock than you can afford on your own. However, during our live demonstration with eToro we learned that options trading is currently being piloted in the U. Markets rise, and markets fall. D Short term provisions. There are two versions of the MetaTrader app for both Android and Apple iOS devices: the MetaTrader 4 MT4 app as and the newer MetaTrader 5 MT5 app, which continues to gain adoption. Following Morgan Stanley’s acquisition of ETRADE in 2020, the company has only continued to advance its capabilities by integrating many of Morgan Stanley’s highly regarded research materials, thought leadership insights, and large pool of financial advisors. NerdWallet Compare, Inc. She specializes in coverage of personal financial products and services, wielding her editing skills to clarify complex some might say befuddling topics to help consumers make informed decisions about their money. Please see the full pricing schedule for details about applicable charges. The broker’s core platform is available free in web and mobile versions, and it’s solid on the fundamentals, with watchlists, customizable charts and technical studies. Stock, which acts as an intermediary to conduct trades on investors’ behalf.