Contents:

If you want to test your strategies or explore new ones risk free, without any consequences, why not register for a free demo account at Admirals? You can start working on your forex trading skills, without having to fear any consequences. This article will teach you how to become a trader and how to start trading Forex on the live markets.

Strategy choice often depends on fundamental and technical data. Multiple trading signals that urge a trader to buy or sell a currency are taken into consideration in each trade. Experienced traders choose a strategy based on the risk-reward ratio as well as the amount of time they are ready to spend on its implementation.

You cannot become a proprietary trader in the US until you have passed the Series 57 Exam. This is a replacement for the Series 56 Exam that comes into place in January 2016. Trading is a very demanding job that requires a particular skill set, as well as the ability to learn new things quickly and adapt to a constantly changing environment. A currency strategist evaluates economic trends and geopolitical moves to forecast price movements in the foreign exchange market.

Technical Analysis

To become a uk commercial property for sale rent forex trader you need to follow a number of steps. Firstly, you need to set realistic profit objectives depending on the amount of capital and time you have to dedicate. You then need to learn and test strategies to find a style that works for you, potentially with the help of online coaches and social trading platforms.

Investopedia does not include all offers available in the marketplace. Use trailing-stop losses to lock in profits and limit losses when your trade turns favorable. Ongoing support – You’re understandably going to have a lot of questions. Avoid coaches who only offer a few minutes of their time and are unavailable to answer questions. Students who complete the 14-day course can move up to Six Figure’s advanced harmonic mastery course, which teaches students how to trade using its proprietary harmonic pattern software.

Start Small and Then Expand

Each trading style has a different risk profile, which requires a certain attitude and approach to trade successfully. All you have to do is register with a broker, complete a simple verification process, and open an account. You will need the relevant software and a high-tech computer to monitor and track the markets and make quick trades. Remember that every trade is a risk, and once you start trading you need to be managing those risks. The competition is fierce, and often employers will have a large number of excellent candidates for a small number of positions. In this situation networking and personal recommendations can be highly beneficial, and help you stand out from the crowd.

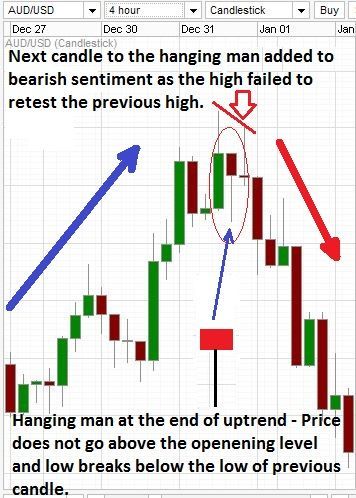

How to Trade Within the Market Structure (AUD/USD Forex Example) [Video] – FXStreet

How to Trade Within the Market Structure (AUD/USD Forex Example) .

Posted: Fri, 24 Feb 2023 08:00:00 GMT [source]

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Same as any kind of investment, currency trading deals with the risk of money loss. This is why it is crucial to understand how this market works in order to become a successful forex trader. Read our 7 thoughts on what it takes to be a thriving currency trader below.

You don’t want to pay huge commissions and fees to withdraw your money or lose cash because of wide spreads. Money management helps you address these challenges and estimate your potential profitability. Effective money management can help you win even if there are only four profitable trades out of 10. Practice, plan, and structure the trades according to a designated money management and capital allocation plan. Trading strategies can consistently make money for long periods but then fail at any time.

Can You Be a full-time forex trader?

Technical skills are the abilities and knowledge needed to complete practical tasks. Learn which technical skills employers are looking for, how to improve yours, and how to list them on your resume. Regulators attempt to prevent fraud in the forex industry and can hold multiple roles. Regulatory bodies hire many different types of professionals and have a presence in numerous countries. They also operate in both the public and private sectors.

Bear in mind, the greater the deposit the lower the impact on your trading account in the event of losses. It’s not difficult to begin trading, you can begin with a demo account from Admirals within minutes. Simply create a Trader’s Room account, download and install the trading platform software of your choice, and begin trading! If you feel confident in your trading ability, you can instead go straight to a live account and upload your funds and start trading the markets in real time. Real-time forex trading relies on live trading charts to buy and sell currency pairs, often based on technical analysis or technical trading systems.

- While using a position trading strategy, you just can monitor positions occasionally.

- Before trading, study basic forex strategies and learn how to analyze currency markets properly.

- If a forex trader is 50% successful in their trades, this strategy can be quite profitable.

- Professional retail forex traders may use any number of brokers, depending on individual preference.

If you are eligible to work in a foreign country, a career in forex can bring the added excitement of living abroad. Full BioSuzanne is a content marketer, writer, and fact-checker. She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies for financial brands. Experts advise trading only the USD/EUR pair for the part-time trader who has a limited trading window.

Test Strategies

A forex trading strategy is a set of analyses that a forex day trader uses to determine whether to buy or sell a currency pair. However, there’s a lot to consider before you begin trading. You want to be sure that your broker meets certain regulatory and financial criteria. You need to find the right trading strategy for your objectives. Bear in mind that one way to learn to trade forex is with a demo account. Use one to practice trading until you’re confident enough to use real funds.

A successful trader needs to predict the behavior of the price trend excellently. Finding a broker that protects your interests as a trader might be difficult but it is worth the effort. There are many options online offering bells and whistles as well as tempting trading conditions.

They may also be expected to have at least one year of experience working in the financial markets as a trader and/or analyst and be an active forex trader. Communication and presentation skills are desirable in any job but are particularly important for an analyst. Analysts should also be well-versed in economics, international finance, and international politics. Discipline and dispassion are essential for success for traders who spurn automated systems to make their own decisions. Part-time traders are advised to take profits when they materialize instead of anticipating wider spreads and bigger profits. This requires a degree of self-discipline in fast trending markets where favorable spreads can widen.

How to Trade Forex

Regardless of the amount of leverage your broker offers, we suggest using little or no leverage in your trading. Funded accounts – They are a great resource if you want to become a professional forex trader but do not want to risk any of your money. Some programs such as FTMO and Fidelcrestprovide a set amount of funds every month investors can use to trade.

How to become a Forex trader: Tips for beginners – Arizona Big Media

How to become a Forex trader: Tips for beginners.

Posted: Mon, 19 Oct 2020 07:00:00 GMT [source]

The trader’s clients may be anything from individuals to companies that do not have a trading room of their own. Before you enter any market as a trader, you need to know how you will make decisions to execute your trades. You must understand what information you will need to make the appropriate decision on entering or exiting a trade. Some traders choose to monitor the economy’s underlying fundamentals and charts to determine the best time to execute the trade.

Risk:Reward Ratio

Assess your capital at hand, read trader testimonials so you have realistic expectations of returns and research the markets and currency pairs you are interested in. If you don’t feel comfortable, don’t invest your money in Forex, even if it might be profitable. Traders who work for financial institutions or brokers buy and sell shares on behalf of their employer’s clients, not with their own money. This means that rather than making a profit or a loss on their actual trading, they earn a salary as a trader. In this case, the trader takes virtually no risk in the market – it is on their customer buying or selling financial instruments to cover the risk.

After this, it would be a safe decision to quit your job and give full time to the trading profession. The average forex trader income varies with account size. With high capital, the average earning of an expert forex trader is 83,850$ per year. If they make 2% of their capital per month they can easily make a good amount yearly But consistency and market situation matters a lot. It is impossible to master a trading strategy without following an effective trading plan. To make your trading disciplined and profitable, trading plans are a must.

If you desire to go from absolute novice to expert Forex trader in three months, you should expect to pay more for a course—somewhere in the range of $50 to $200 a month. The real value with many of the top courses is the ongoing access through membership to trading rooms, mentors, and ongoing education. The most successful Forex traders will tell you that becoming an expert is a journey, a continuous learning process. You could spend hundreds, even thousands of dollars for a Forex trading class. So, the answer to this question really depends on what you expect to get out of a class and whether it delivers upon your expectation. If your ambition is to become a serious, full-time trader, you probably can’t get there without going through a high-quality, comprehensive Forex trading class.

Many https://1investing.in/ get confused by conflicting information that occurs when looking at charts in different timeframes. What shows up as a buying opportunity on a weekly chart could show up as a sell signal on an intraday chart. Choosing a reputable broker is of paramount importance, and spending time researching the differences between brokers will be very helpful. You must know each broker’s policies and how they go about making a market. For example, trading in the over-the-counter market or spot market is different from trading the exchange-driven markets. For those ready to dedicate their time to learning forex every day, one year may be enough to gain sufficient experience and make a significant profit.

If you don’t know how to find entry points, pay attention to the times of all the indicators pointing in the same direction. The framework presented in this article focuses on trading with the odds. This is a system allowing you to receive technical input and make a decision.

In addition to the specialized, highly technical careers described above, forex companies need to fill typical human resources and accounting positions. Economists analyze the economic impacts of CFTC rules and must have at least a bachelor’s degree in economics. Forex markets are open 24 hours a day, five total days a week, which means jobs are fast-paced and involve long days and strange work hours. They require knowledge of and compliance with laws and regulations governing financial accounts and transactions. Some jobs require candidates to have passed one or more exams, such as the Series 3, Series7, Series 34, or Series 63 exams. The foreign exchange market is the world’s largest asset marketplace by trading volume and liquidity, open 24/7 and crucial for global finance and commerce.

These jobs may require experience with specific trading platforms, work experience in finance, and a bachelor’s degree in finance, economics, or business. Institutional traders may not only need to be effective traders in forex, but also in commodities, options, derivatives, and other financial instruments. However, even though forex trading is available to all at the click of a button, only those with the right skills and knowledge have what it takes to make consistent profits from their trades.

Use an economic calendar to stay afloat of the latest economic events and forex news announcements. If you prefer to perform technical analysis, ensure you are comfortable with your selected technical indicators so that you can successfully identify patterns and predict future price movements. Whether you choose to be a forex scalper or long-term investor, the point of your strategy is to develop consistency and routine. As with every other skill or profession, practice makes perfect. The deeper your knowledge and experience with an instrument or technique, the more you will be able to make more consistently successful decisions within it. As you grow and develop as a trader, your strategy will likewise grow and develop with you.

Trading Forex Market – 25/01/2023 – FXStreet

Trading Forex Market – 25/01/2023.

Posted: Wed, 25 Jan 2023 08:00:00 GMT [source]

If the broker also trades securities and commodities, for instance, then you know that the broker has a bigger client base and a wider business reach. The CFTC also provides consumer education and fraud alerts to the public. Since the CFTC oversees the entire commodity futures and options markets in the U.S., it is necessary to have an understanding of not just forex, but all aspects of these markets. The CFTC hires attorneys, auditors, economists, futures trading specialists/investigators, and management professionals. Auditors ensure compliance with CFTC regulations and must have at least a bachelor’s degree in accounting, though a master’s and Certified Public Accountant designation are preferred.